glindapicard95

Sobre glindapicard95

Exploring Numerous Ways To Buy Gold: A Comprehensive Guide

Gold has lengthy been considered a protected-haven asset and a hedge in opposition to inflation. Its intrinsic value and historical significance make it a preferred alternative for buyers looking to diversify their portfolios. With numerous ways to buy gold, from bodily bullion to monetary products, this article explores the different methods and concerns for purchasing this precious steel.

1. Bodily Gold

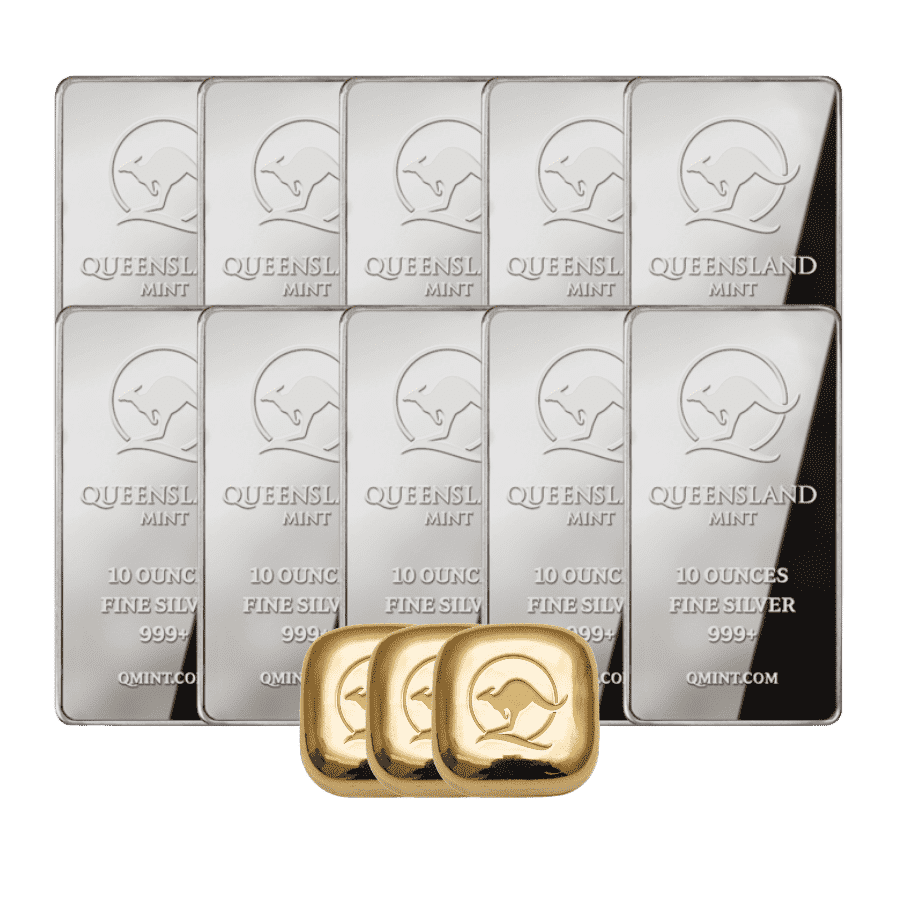

a. Gold Bullion

One of the vital simple ways to buy gold is through bodily bullion, which includes gold bars and coins. Buyers can purchase gold bullion from respected sellers, banks, or mints. Gold bars come in various sizes, sometimes starting from one ounce to bigger sizes, while coins just like the American Gold Eagle or the Canadian Gold Maple Leaf are in style as a result of their legal tender status and recognizability. If you cherished this article and also you would like to receive more info about buynetgold nicely visit our own web-site. When shopping for bullion, it’s essential to think about purity (normally 99.9% for investment-grade gold) and ensure the supplier is reputable to keep away from counterfeit merchandise.

b. Gold Jewelry

Investing in gold jewelry could be another manner to amass gold, although it is probably not the most efficient investment technique. Jewelry often comes with a premium on account of craftsmanship and design, and its resale worth could be decrease than that of bullion. Nonetheless, for many who appreciate aesthetics and wearability, gold jewelry can function each an funding and a personal adornment.

2. Gold ETFs and Mutual Funds

For traders who prefer not to hold physical gold, Exchange-Traded Funds (ETFs) and mutual funds provide a superb alternative. Gold ETFs are designed to trace the price of gold and may be bought and bought on inventory exchanges like common stocks. They provide liquidity and ease of entry with out the necessity for storage or insurance coverage related to bodily gold.

Mutual funds that target gold mining corporations or gold-associated property also can provide publicity to gold prices. These funds permit buyers to diversify their holdings while still benefiting from the efficiency of the gold market.

3. Gold Mining Stocks

Investing in gold mining stocks is one other oblique manner to realize publicity to gold. By buying shares of corporations that mine for gold, investors can doubtlessly profit from each the rising price of gold and the operational success of the mining firms. Nonetheless, investing in mining stocks carries extra risks, including operational challenges, administration decisions, and geopolitical factors that will have an effect on mining operations.

4. Gold Futures and Choices

For more experienced investors, buying and selling gold futures and options will be an efficient strategy to speculate on gold costs. Futures contracts obligate the buyer to purchase gold at a predetermined price on a selected date, while choices give the purchaser the best, but not the obligation, to buy or sell gold at a set worth earlier than a certain date. These financial devices can offer vital leverage, but in addition they include greater threat and complexity, making them appropriate for those who have a strong understanding of the commodities market.

5. Gold Certificates

Gold certificates are one other method of investing in gold without the need for bodily possession. These certificates symbolize ownership of a specific amount of gold held in a vault by a financial establishment. They can be traded like stocks and supply a handy approach to invest in gold without the challenges of storage and safety. Nevertheless, it’s crucial to make sure that the issuing institution is respected and that the certificates are backed by actual gold.

6. On-line Gold Dealers

The rise of expertise has made it simpler than ever to buy gold online. Numerous online dealers offer a variety of gold merchandise, including coins, bars, and collectibles. When buying gold on-line, it’s essential to do thorough research on the seller, verify reviews, and verify that they are respected and trustworthy. Moreover, consumers should remember of transport and insurance prices, which may add to the general expense of the purchase.

7. Gold Savings Accounts

Some banks and monetary establishments offer gold savings accounts, permitting prospects to invest in gold with out needing to buy physical gold. These accounts typically allow investors to purchase gold at market prices, and the gold is saved securely by the bank. This methodology supplies liquidity and ease of entry, making it a beautiful choice for individuals who wish to invest in gold with out the problem of bodily storage.

8. Concerns When Buying Gold

When deciding on how to buy gold, several components should be taken into account:

a. Function of Investment

Understanding the rationale for investing in gold is crucial. Whether or not for wealth preservation, hypothesis, or jewellery, each goal might influence the choice of gold investment.

b. Market Situations

Gold prices will be risky, influenced by various factors comparable to geopolitical occasions, inflation rates, and foreign money fluctuations. Keeping an eye on market trends can assist investors make informed selections.

c. Storage and Security

For these buying bodily gold, contemplating how and where to retailer it is essential. Choices include dwelling safes, bank security deposit bins, or safe storage facilities. Each option has its professionals and cons relating to accessibility, value, and security.

d. Prices and Premiums

When buying gold, traders ought to remember of the premiums associated with different merchandise. Bullion typically has lower premiums than jewellery, but components like rarity and demand can have an effect on pricing.

e. Taxes and Regulations

Investors must also consider the tax implications of shopping for and selling gold. Capital positive aspects tax might apply, and regulations can vary by country, so it’s wise to seek the advice of with a tax skilled.

Conclusion

Investing in gold can be a rewarding endeavor, providing a hedge towards financial uncertainty and a means of preserving wealth. With various methods available, from physical bullion to financial merchandise, traders can select the method that best aligns with their objectives and risk tolerance. By understanding the different ways to buy gold and contemplating the related factors, traders could make informed choices that suit their financial strategies.

No listing found.